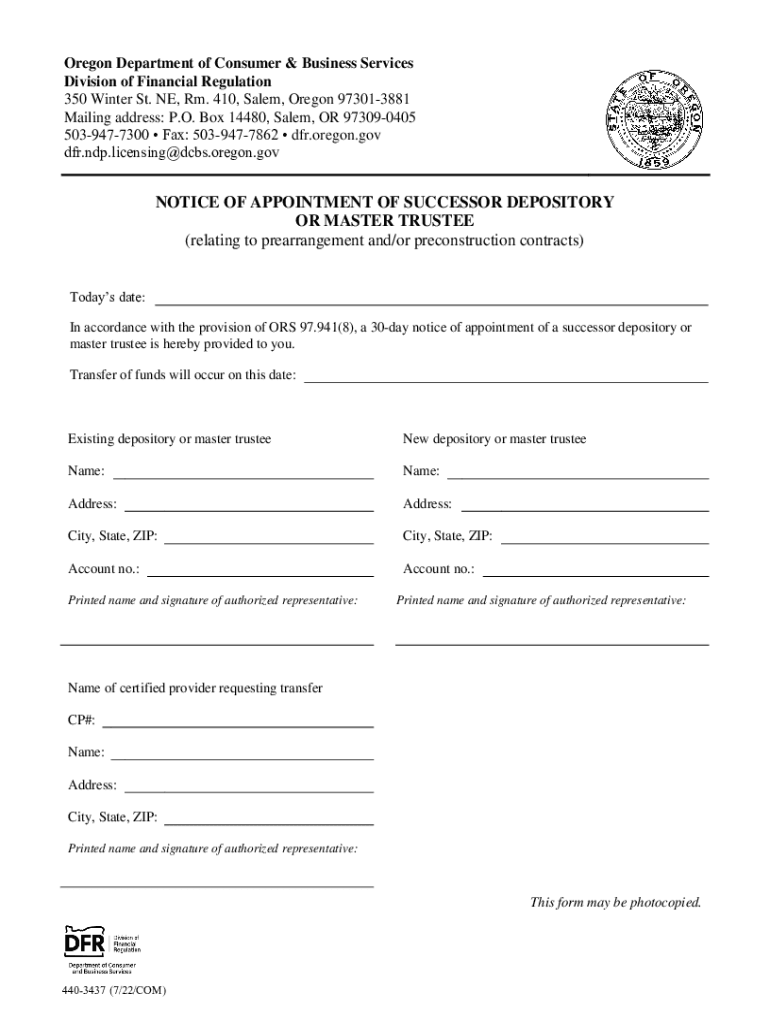

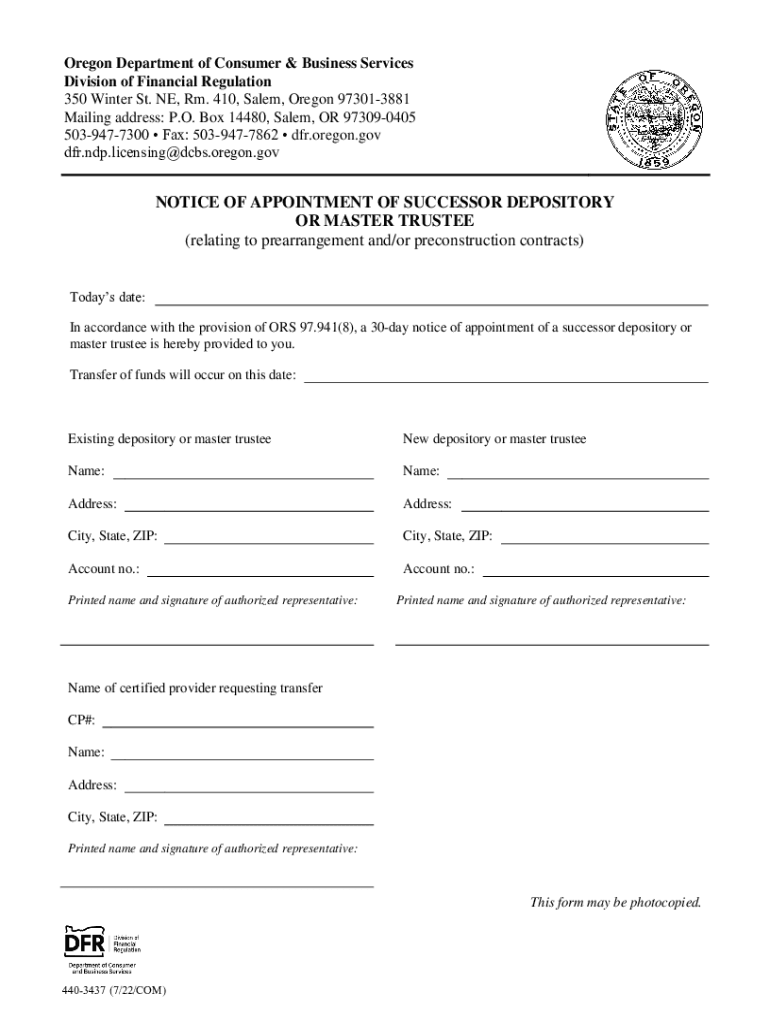

OR 440-3437 2022-2024 free printable template

Get, Create, Make and Sign

How to edit acceptance of successor trustee form online

OR 440-3437 Form Versions

How to fill out acceptance of successor trustee

How to fill out notice of appointment of

Who needs notice of appointment of?

Video instructions and help with filling out and completing acceptance of successor trustee form

Instructions and Help about successor trustee form

Hi. IN×39’m Amir Atari Rang. And I'm Laura Hawkins. We×39’re with the Atari Rang Law Firm, and we×39;redoing to talk to you a little further about what a successor trustee has to do. In addition to the more well-known steps the successor trustee has to take, you will be responsible for filing the last income tax returns for the decedent. You may also have to file a fiduciary income tax return. This basically means that the trust estate, while it×39;spending, has to account for its own income taxes. It×39;through a Form 1041. Now it's very important to note that if the successor trustee does not file fiduciary income tax return, then he or she may be personally liable for those taxes. The next step in the trust administration is the accounting. The California Probate Code requires that a successor trustee who is administering an irrevocable trust prepare and render an accounting of their actions and administration of the trust. To satisfy that legal requirement, you must keep a detailed accounting records of the trust. Now, after all the assets have been collected and marshaled, after the debts have been paid, after the successor trustee deals with thedecedent'’s income tax return and the fiduciary income tax returns, and as Laura just mentioned, after the successor trustee renders a formal accounting to the beneficiaries, then the trust is in a position to assess making distributions to those beneficiaries. Duet the complicated nature of all these moving pieces, it's really important for a successor trustee to work with attorneys like us to make sure that they are complying with all the rules and regulations. This video has been brought to you by the Atari Rang Law Firm, where we're building lifetime relationships, one client at a time. Thank you for watching.

Fill trustee acceptance letter : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Fill out your acceptance of successor trustee online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.